Democrat lawmakers in Maine are looking to impose an additional four percent tax on capital gains earned by residents over a certain threshold.

Capital gains refers to the increase in the value of an asset between the time it is acquired and when it is sold. These assets include a wide range of investments, including stocks, bonds, or real estate, as well as items purchased for personal use, like furniture or a boat.

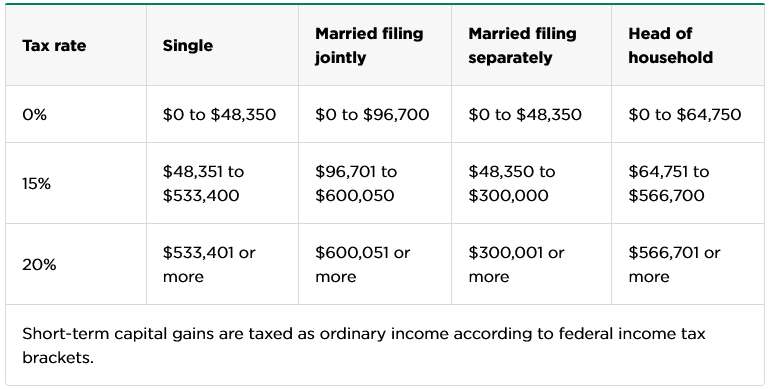

Short-term capital gains — or those earned on an asset owned for less than a year — are taxed alongside all other income in accordance with an individual’s regular income tax bracket.

Long-term capital gains, on the other hand, are subject to their own specific tax rate of 0 percent, 15 percent, or 20 percent, depending upon a person’s taxable income and filing status.

Most filers are required to pay 15 percent of their long-term capital gains in taxes.

Currently, Maine taxes capital gains alongside all other forms of income. Under the current structure, this means that they are taxed at a rate of 7.25 percent at most.

Should LD 1047, sponsored by Rep. Grayson B. Lookner (D-Portland), pass and be signed into law, it would impose an additional four percent tax on any capital gains earned over a particular threshold, bringing the maximum tax rate on this portion of Mainers’ income to 11.25 percent.

Subject to this additional tax would be capital gains over $250,000 for those who are single or married filing separately, $375,000 for heads of household, and $500,000 for those who are married filing jointly.

Cosponsoring this legislation are Sen. Denise Tepler (D-Sagadahoc), Rep. Matthew D. Beck (D-South Portland), Rep. Deqa Dhalac (D-South Portland), Rep. Gary Friedmann (D-Bar Harbor), Rep. Drew Gattine (D-Westbrook), Rep. Tavis Rock Hasenfus (D-Readfield), Rep. Ann Higgins Matlack (D-St. George), Rep. Amy J. Roeder (D-Bangor), and Sen. Mike Tipping (D-Penobscot).

LD 1047 has been referred to the Taxation Committee, but a public hearing has not yet been announced.

Click Here for More Information on LD 1047

This is not the only Democratic proposal that has been introduced so far this year that seeks to amend the state’s income tax code.

Sponsored by Rep. Matlack, LD 229 seeks to restructure Maine’s income tax brackets so as to impose higher taxes on those who earn more than $144,500 per year.

If approved, this proposal would see the state’s highest earners be taxed by up to 1.05 percent more than they currently are, bringing Maine’s maximum tax rate to 8.2 percent.

To accomplish this, three new tax brackets would be added to encompass individuals earning over $144,500, heads of household earning more than $216,750, and married couples making over $289,000.

The proposed law would also nearly double the upper threshold for the state’s lowest income tax bracket, allowing a broader swath of Mainers to qualify for it.

A public hearing for this bill was held at the end of February, and the Taxation Committee has scheduled a work session for Wednesday, March 13.

0 Comments