Mainers statewide have been experiencing sticker shock when reviewing their property tax bills for the upcoming fiscal year.

From higher rates and higher valuations to decreased exemptions and stretched household budgets, Maine residents — especially those with fix-incomes or lower incomes — are getting squeezed.

Considering Maine already has the fourth highest tax burden in the country — and the highest property tax burden of any state — Mainers are feeling the property tax pinch more than ever.

The Maine Wire has received numerous messages from Maine taxpayers in towns from Gray to Newcastle to Carthage reporting dramatic property tax hikes reflected in their FY25 bills.

While rising budget costs are often to blame for more expensive property tax bills, many of these increases appear to be the direct result of revaluations that have been conducted in response to the changes that have taken place in Maine’s housing market.

Under Maine’s constitution and state law, real estate must be assessed “according to [its] just value,” which according to case law, is equivalent to its market value, or the price for which one could reasonably expect it to be sold.

A law approved by the Legislature in 1975 directed municipalities to have a minimum assessment ratio of 70 percent, meaning that the tax assessed value of a given property is not supposed to be less than 70 percent of its market value.

Generally speaking, municipalities undertake revaluations when they fall below this 70 percent threshold, whether that be due to the passage of time or a significant shift in the housing market.

Tied to this ratio are the value of residents’ property tax exemptions — such as the homestead exemption. For example, if a municipality’s property assessment is calculated to be at 80 percent of market value, homeowners are only eligible to take 80 percent — or $20,000 — of the state’s $25,000 homestead exemption.

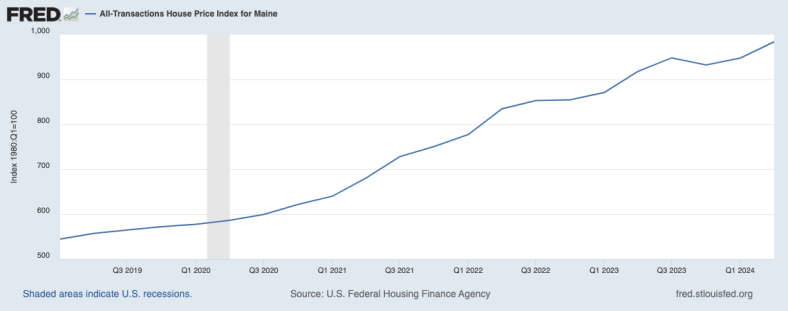

Since 2019, home prices in Maine have nearly doubled, according to data tracked by the St. Louis Federal Reserve. Those new sale prices contribute to the new valuations of houses that aren’t on the market, which means Mainers who have owned their homes for 20 years or more are suddenly on the hook for paying twice the property tax — even if their income has hardly grown.

The most recent round of revaluations in cities and towns throughout the state have caused many homeowners to experience sudden, substantial, and unexpected increases in their property tax bills for FY25.

The Town of Newcastle — located in Lincoln County with a population just over 1,800 — was one of many municipalities to conduct a revaluation this year, resulting in significantly higher property tax bills for residents.

According to a presentation released by the Town, the average assessed value of real estate increased by 40 percent.

Despite the Town’s mill rate — or the amount of tax charged per $1,000 of property valuation — decreasing for FY25, many residents’ taxes increased as a direct result of the reevaluation.

One Newcastle resident who reached out to the Maine Wire said their property tax bill increased 51 percent compared to the previous year.

Another resident of Newcastle told the Maine Wire that their property taxes, along with many others, “took a huge jump with no warning.” In their case, their property tax bill increased by 30 percent, rising from about $6,000 per year to $8000 per year.

The Town of Gray — located in Cumberland County with a population of just over 8,000 — also recently conducted revaluations.

According to KRT Appraisal, the firm hired to conduct the revaluation, Gray had previously assessed real estate at 57 percent of its market value. Following this revaluation, however, properties are now estimated to be assessed at 95 percent of their market value.

One Gray resident told the Maine Wire that their home, which was built about fifteen years ago for nearly $200,000, has just been revalued at over $500,000.

Residents of South Portland were shocked earlier this month when they received their FY25 property tax bills, most of which were significantly higher than in previous years as a result of the City’s most recent revaluation.

The City’s Frequently Asked Questions page revealed that a major of goal of this revaluation was to shift the majority of the tax burden from commercial properties to residential ones, as “commercial property sales…have been outpaced by the residential market.”

“In other words, property value growth on the residential side will outpace growth on the commercial side and as a result, residential property owners will bear more of the property tax burden,” the City wrote.

A similar dynamic played out in Brunswick this year, where property taxes were also rebalanced between residential and commercial properties, resulting in some owners of modest homes seeing massive increases in their tax bills.

Bradley — a Penobscot County town with just over 1,500 residents — also conducted a revaluation for the coming fiscal year.

“This is a restoration of equity and not a back-door tax increase. A revaluation has nothing to do with the size of the overall tax commitment; it merely adjusts how it is apportioned,” the town said in a statement posted to their website. “All Bradley properties are valued from the same land and building schedules. No one is catching a break nor is anyone being treated unfairly.”

One Bradley resident wrote to the Maine Wire saying that they have lived in their home for more than three decades and saw their property taxes increase by $700 this year.

According to a Frequently Asked Questions document posted to the town’s website, Bradley’s assessment ratio was calculated at 69 percent prior to this revaluation. Property values had last been reassessed in 2009.

In addition to these widespread revaluations, Mainers have also been facing significant property tax increases as a result of heightened local spending.

In Maine’s larger municipalities, growing General Assistance and education expenses have placed pressure on local budgets.

Towns that have seen an influx of asylum seekers relocating, and therefore a need to hire English as a Second Language (ESL) instructors throughout the school systems, have experienced even more pressure to increase local taxes.

For example, Westbrook voters narrowly approved a $51 million school budget accompanied by a 13 percent property tax increase earlier this year.

Voters in Lewiston rejected two iterations of the school budget — both carrying a property tax increase of about 13 percent — before approving a version totaling $109.6 million and raising taxes by 9 percent.

Gorham’s $53 million school budget — which necessitated a 9.05 percent property tax increase — was approved by just two votes. Originally believed to have prevailed by four votes, a recount revealed a much slimmer margin.

According to a recent study conducted by personal finance website WalletHub, Mainers currently bear the nation’s highest property tax burden, contributing an estimated 4.86 percent of their personal income to these taxes.

For comparison, residents of Alabama — the state found to have the lowest property tax burden — pay just 1.33 percent of their personal income in property taxes.

The end of rising property tax bills may be nowhere in sight. Several towns have yet to undergo their revaluations, meaning similar hikes could be coming down the pipeline over the next 2-3 years.

Adding to the concern is that the State Legislature’s decision earlier this year to abolish the 2005 cap placed on municipal property tax increases.

In April, the Democrat-controlled legislature passed a new bill repealing the property tax cap, and Gov. Janet Mills signed it into law.

0 Comments